Renters Insurance in and around Little Rock

Welcome, home & apartment renters of Little Rock!

Renting a home? Insure what you own.

Would you like to create a personalized renters quote?

- Little Rock, AR

- West Little Rock

- Midtown

- Texas

- Missouri

- Downtown Little Rock

- The Heights

- Arkansas

There’s No Place Like Home

There's a lot to think about when it comes to renting a home - location, parking options, size, condo or townhome? And on top of all that, insurance. State Farm can help you make insurance decisions easy.

Welcome, home & apartment renters of Little Rock!

Renting a home? Insure what you own.

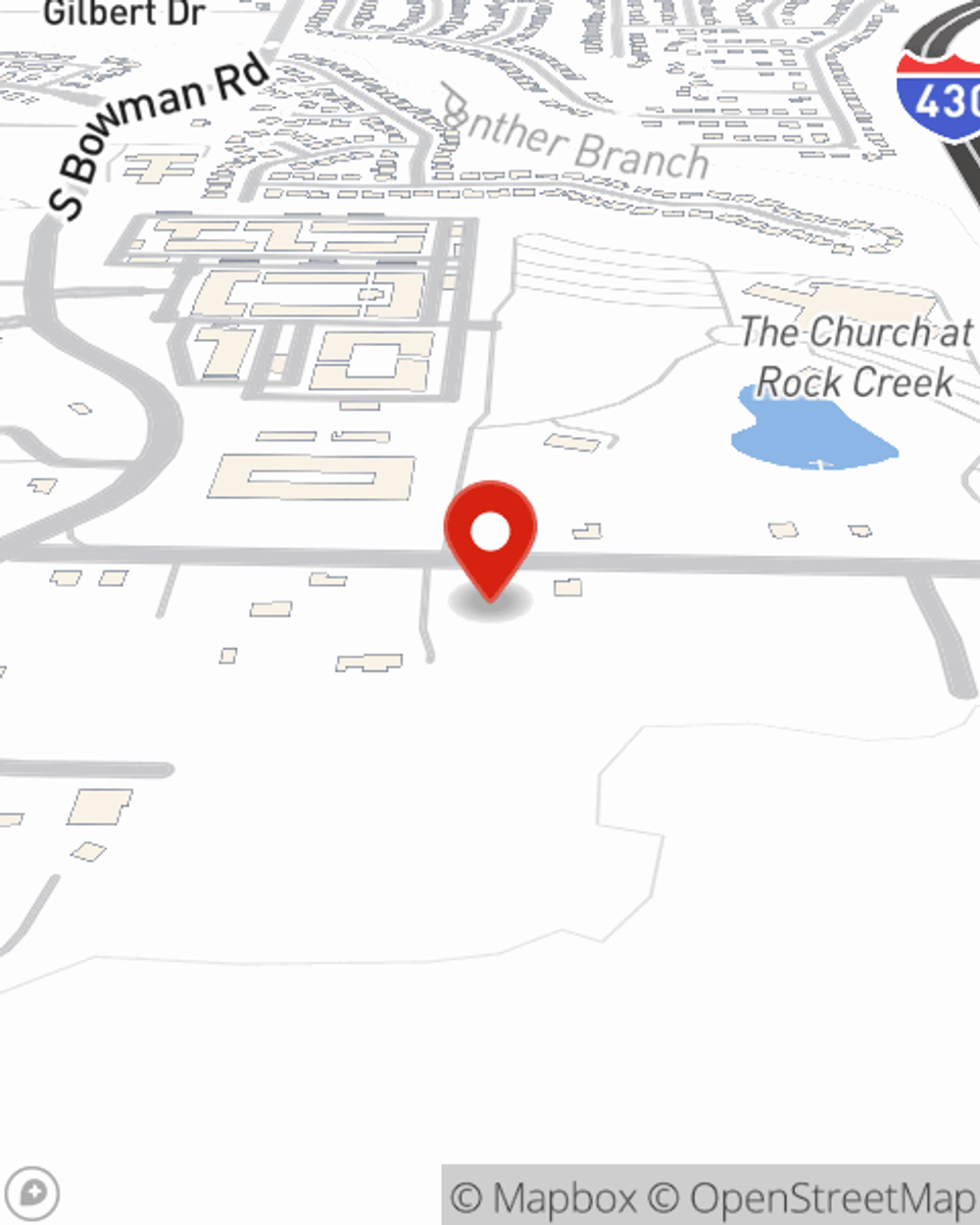

Agent Whitney Owens, At Your Service

When the unexpected abrupt water damage happens to your rented apartment or condo, usually it affects your personal belongings, such as a set of favorite books, a bicycle or a desk. That's where your renters insurance comes in. State Farm agent Whitney Owens has the knowledge needed to help you understand your coverage options so that you can protect your belongings.

It's always a good idea to make sure you're prepared. Get in touch with State Farm agent Whitney Owens for help understanding options for your policy for your rented space.

Have More Questions About Renters Insurance?

Call Whitney at (501) 568-5516 or visit our FAQ page.

Simple Insights®

Power outage preparedness tips

Power outage preparedness tips

Learn some power outage preparedness tips, including what do before, during and after it happens.

The landlord's guide to the eviction process

The landlord's guide to the eviction process

Evictions can be a lengthy, daunting process for landlords and tenants, so it’s important for you to be aware of the specific reasons, procedures and costs.

Whitney Owens

State Farm® Insurance AgentSimple Insights®

Power outage preparedness tips

Power outage preparedness tips

Learn some power outage preparedness tips, including what do before, during and after it happens.

The landlord's guide to the eviction process

The landlord's guide to the eviction process

Evictions can be a lengthy, daunting process for landlords and tenants, so it’s important for you to be aware of the specific reasons, procedures and costs.